Stallion Gold has agreed to acquire all of the issued and outstanding securities of privately held uranium company, U92 Exploration Limited (U92).

However, there is no assurance that the deal could be concluded as planned or at all, Stallion stated.

The transaction is subject to certain closing conditions, including, securing all relevant clearances.

Under the share purchase agreement, Stallion Gold will pay $300,000 to U92 shareholders.

Stallion will also issue three million shares, at $0.10 apiece, to the holders of U92 common shares.

In a press statement, Stallion said: “The consideration shares will be subject to a restriction of resale for four months and one day from the date of closing.”

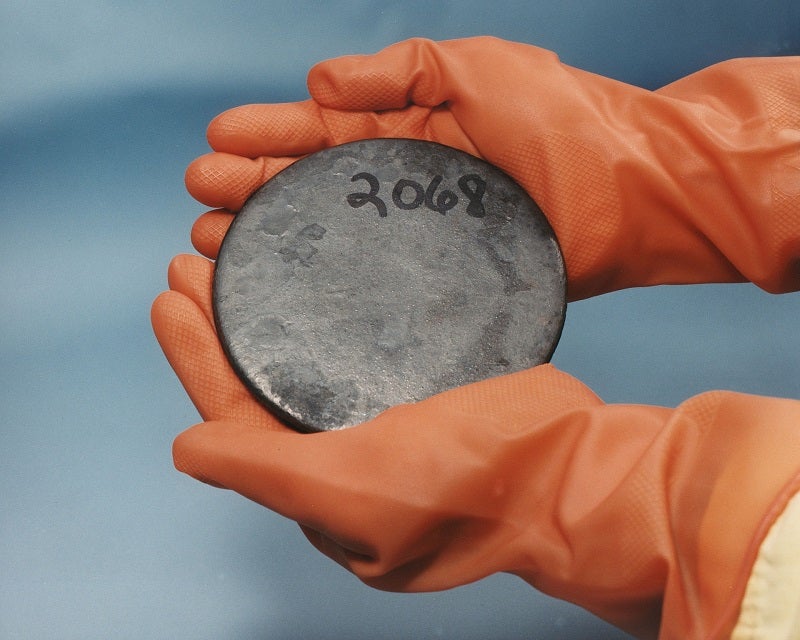

U92 holds strategic claims in the Western Athabasca Basin, which is said to host some of the world’s largest high-grade uranium discoveries.

The uranium firm owns six mineral claims that cover a total area of 29,273ha in Saskatchewan, Canada.

Stallion CEO Drew Zimmerman said: “We are excited to be acquiring projects in this region of the Athabasca Basin, which is poised to become the next major area for new uranium operations in northern Saskatchewan.

“Given the extreme proximity of these claims to recent high-grade discoveries we see tremendous potential in creating value for all stakeholders by deploying the exploration techniques being utilised to the area.”

During the first quarter of this year, the company plans to start a work programme on the newly acquired claims.

Stallion also plans to change its name to Stallion Discoveries Corp. to better reflect its focus as a large-scale, multi-resource project explorer.