Chinese mining firm Tianqi Lithium has received approval from the Hong Kong Stock Exchange for its proposed listing in the city, reported Bloomberg News citing parties familiar with the development.

The decision follows a hearing with the Hong Kong bourse’s listing committee.

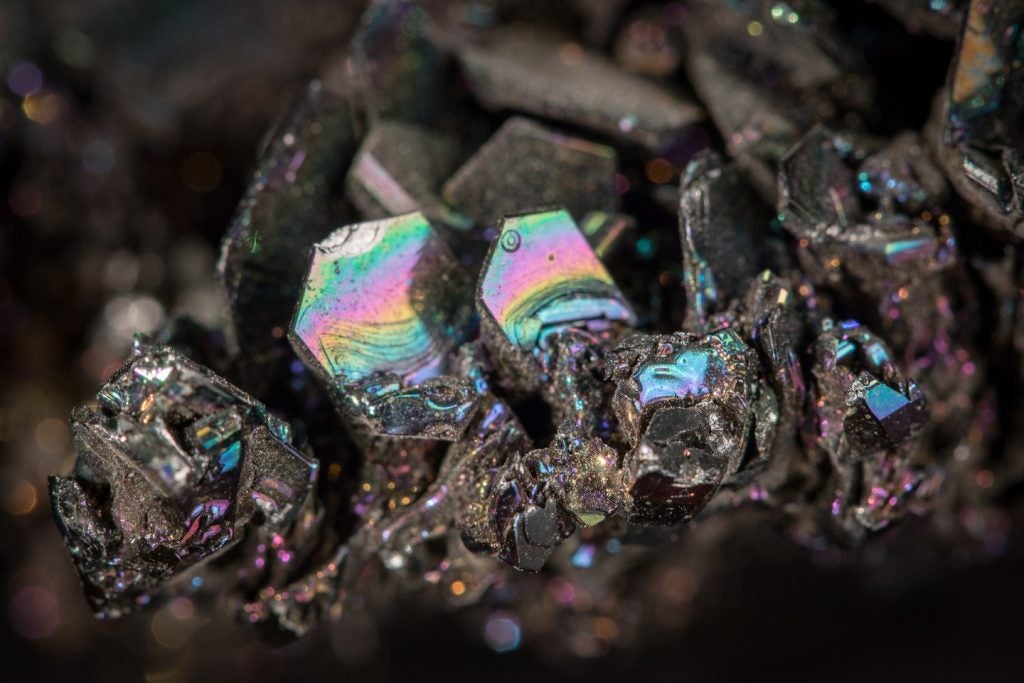

Listed on the Shenzhen Stock Exchange, Tianqi Lithium is engaged in lithium resource investment, lithium concentrate extraction and advanced lithium speciality compound production.

The firm’s resource and production assets are located in the pre-eminent lithium regions of Australia, Chile and China.

According to the Bloomberg report, the firm is looking to generate $1bn-$1.2bn with the sale of shares.

For the offering, Tianqi Lithium plans to begin assessing investor demand from next week.

At a $1bn valuation, it is reported that Tianqi’s offering would mark the biggest listing on the Hong Kong stock exchange so far this year.

The people said that the company is in talks while the timing and fundraising amount could be changed.

According to a preliminary prospectus, the deal’s joint sponsors include China International Capital Corp., Morgan Stanley, and CMB International Capital.

There was no official confirmation from Tianqi Lithium on the development.

Last year, Tianqi Lithium and Australian miner Independence Group (IGO) completed a $1.4bn joint venture (JV) deal for Tianqi’s Australian assets.

The JV, in which Tianqi owns a 51% stake and IGO holds a 49% interest, focuses on the existing upstream and downstream lithium assets in Western Australia.